![]()

Compact UV-C LED. [Image: Morrow363/Wikimedia Commons; CC-BY-SA 4.0]

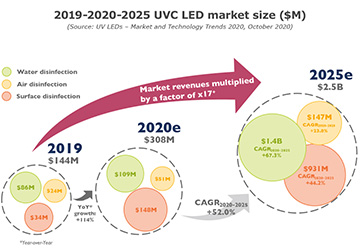

In a recently published report, the market-research firm Yole Développement projects that the global market for UV-C light-emitting diodes (LEDs) could balloon from US$144 million in 2019 and US$308 million in 2020 to US$2.5 billion in 2025—a five-year compound annual growth rate of 52.0%. Driving this dizzying projected growth is the COVID-19 pandemic, which has sharpened the world’s appetite for the use of the devices for disinfecting not only surfaces, but air and water as well.

“The COVID-19 pandemic,” the company writes, “has created momentum for the UV-C LED industry.” The report also notes that the sudden demand flood comes after a long dry spell for these units, and that meeting it will require the industry to ramp up capacity rapidly.

LEDs vs. lamps

A variety of scientists and groups have suggested wide-ranging prospects for germicidal UV-C light (which occupies the 200-to-280-nm wavelength band) as part of the solution to the COVID-19 crisis. These range from visions of installing UV-C lamps in office air ducts to scrub coronavirus from them, to low-cost systems designed to sterilize reusable personal protective equipment, such as N95 masks. (One such project, which is making designs for low-cost, easily assembled UV sterilization cabinets available in low-income countries, is partly supported by the OSA Foundation, the charitable arm of The Optical Society, OPN’s publisher.)

Many of these schemes have relied not on UV-C LEDs, but on conventional UV-C lamps. On a price-per-watt basis, LEDs in this spectral band are far more expensive than ordinary UV-C tubes. However, Yole points out that the comparisons have rapidly improved, with UV-C LED prices trending down from around US$100/mW in 2015 to between US$0.30/mW and US$$2.00/mW in 2019. UV-C LED makers will need to continue this development and push prices down further to make the devices competitive with conventional lamps.

Yole notes that progress in UV-C LED competitiveness has been driven by a number of firms in the Republic of Korea that have nurtured the technology over the past decade. One of those, LG Innotek, moved out of the market before the pandemic started, frustrated, according to Yole, with the ongoing losses the business was experiencing.

In contrast, another technology leader, the Seoul Viosys arm of Seoul Semiconductor, has stuck with the business, and even had an initial public offering in late February 2020, as the pandemic and UV-C’s germicidal potential were gaining worldwide attention—showing, Yole says, “what can be considered as the best timing ever.”

Capacity crunch

These and other suppliers will need to boost capacity very quickly to take advantage of the rapidly swelling demand for germicidal light. The Yole report notes that operators in this niche area were unprepared for the scale of potential new business engendered by the pandemic, which “has created such a peak in demand that an overall shortage appeared across the entire UVC LED supply chain in 2020.” Indeed, the firm argues that the greater-than-100% increase in market size between 2019 and 2020 that it’s projecting “could have been even bigger if production capacity could keep up with demand.”

That said, Yole does expect UV-C suppliers to rapidly address that deficiency. The report notes, for example, that as of the 2020 third quarter, “more than 300 million units of capacity have been announced to be installed in the short term.”

[Image: Courtesy of Yole Développement] [Enlarge image]

From surface to water disinfection

While much of the near-term action could be in the disinfection of surfaces against COVID-19, in the longer term Yole expects water disinfection to be the more important driver. The report envisions the market for UV-C LEDs for surface disinfection to grow from a projected US$148 million in 2020 to US$931 million in 2025, a 44.2% CAGR. UV-C LEDs for water disinfection, the company estimates, could expand at a blistering 67.3% over the same period, going from US$109 million in 2020 to US$1.4 billion in 2025.