CMOS image sensor. [Image: Filya1/Wikimedia Commons]

In a recently released report, the French market research firm Yole Développement is projecting compound annual growth of 9.4 percent in the worldwide CMOS image sensor (CIS) market over the next five years. That’s slightly faster growth than projected in previous forecasts from company—and is, according to the Yole study, being driven by a combination of operating recovery at the industry’s leading player and new opportunities both in end-user markets and in the broader semiconductor industry.

Recovery for Sony

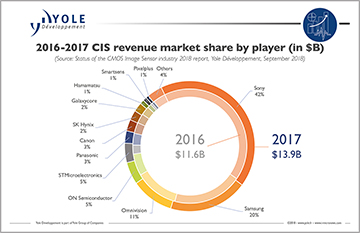

The Yole report, authored by long-time imaging industry figures Pierre Cambou and Jean-Luc Jaffard, estimates that 2017 revenues for the CIS industry reached US$13.9 billion, up some 20 percent year to year owing especially to strength in mobile markets. One notable event, Cambou and Jaffard note, was the 2017 operating recovery of Sony’s foundry in Kumamoto, Japan, after a magnitude 7.0 earthquake devastated the facility in April 2016. The facility’s 2017 comeback pushed up industry-wide revenues, as Sony dominates the CIS market with a muscular 42 percent share (the next-biggest player, Samsung, owns 20 percent of the market).

CMOS image sensor market shares, by company. [Image: Courtesy of Yole Développement] [Enlarge image]

There has, however, been strong news for other, niche players in particular market segments, according to the Yole analysis. For example, while its 5 percent overall share is much smaller than that of Sony or Samsung, ON Semiconductor has become, authors Cambou and Jaffard note, “the key player in automotive” despite increasing competition in that arena from the two industry leaders. And the niche player STMicroelectronics “stole the show” in 2017, according to the report, by snagging a spot in the new iPhone X with a near-infrared global shutter based on a silicon-on-insulator substrate. Indeed, the study suggests that STMicroelectronics’ share of the overall market doubled, to 5 percent, between 2016 and 2017.

More CIS dollars per smartphone

These developments at individual companies hint at the larger forces driving expansion in the CIS industry. Among the most significant, according to Cambou and Jaffard, are the proliferation of “dual camera approaches” in mobile phones. Dual cameras are becoming increasingly common, the Yole study notes, to improve resolution, low-light performance and optical zoom, and to enable functionalities such as face recognition and (for the iPhone X) 3-D sensing. Thus, despite a slowdown in growth for the mobile market generally, the CIS part of the business has “benefited from ever-increasing dollar content per smartphone.”

In a similar vein, the Yole study suggests that the automotive segment of the CIS market will benefit from a worldwide move “toward ever-increasing numbers of cameras per car,” for collision-avoidance systems, parking-assist systems and even rear back-up cameras (which, the report notes, have become mandatory in the United States). And, in the security sector—which has, according to the report, become one of the most active CIS markets—increases in cloud computing and artificial intelligence mean that “number of cameras per security system isn’t limited by human monitoring anymore.” This, the Yole analysts suggests, represents “a paradigm shift for surveillance” that could further drive industry growth.

China rising?

The growth of the security side of the CIS market is, according to Yole, “tightly connected to Chinese involvement in the industry,” and particularly to the activity of two large Chinese OEM manufacturers, Hikvision and Dahua, in the security arena. But the report suggests that China’s progress on the supply side of the CIS industry could also prove a major story, as the country has built a “consistent ecosystem” incorporating CIS foundries and vendors as well as system manufacturers. Thus, report authors Cambou and Jaffard expect China’s role in the worldwide market to increase in the future.

More information on the Yole report is available at https://www.i-micronews.com/category-listing/product/status-of-the-cis-industry-2018.html.