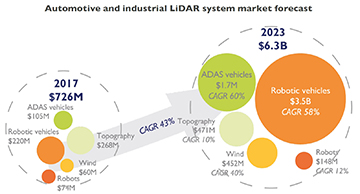

The Yole Développement report looked at both the automotive and industrial components of the lidar market. [Image: Yole Développement] [Enlarge image]

A May 2018 report from the French market research firm Yole Développement projects that the market for automotive lidar will balloon from an estimated US$325 million in 2017 to some US$5.2 billion in 2023, marking out a dizzying compound annual growth rate (CAGR) of almost 59 percent for the period. And in the years that follow, according to the report, the yearly growth pace will slow to a still-blistering 21 percent, with the auto-lidar market value expected to expand to some US$28 billion by 2032.

Autonomous cars set the pace

The report, coauthored by analysts Alexis Debray and Guillaume Girardin, also looks at the industrial side of the lidar market, including applications such as mapping and topography, wind measurement (a mandatory application for the development of wind-farm energy), and industrial robotics. For the automotive and industrial lidar components together, the analysts envision growth from US$726 million in 2017 to US$6.3 billion in 2023, a 43 percent CAGR.

Within that integrated picture, however, it’s clearly automotive lidar—defined in the report as systems for both fully autonomous “robotic” vehicles and those with advanced driver-assistance systems (ADAS)—that’s calling the tune. The robotic-vehicles segment in particular could expand from US$220 million in 2017 to US$3.5 billion in 2023, according to the report, driven by an anticipated expansion of robotic vehicles from a handful at present to more than 100,000 in five years. And the Yole Développement analysts believe that the number could top 1 million robotic cars by 2032.

“Impressive diversity” of lidar tech

The report also calls out the “impressive diversity” of the automotive-lidar scene—a diversity that plays out along a range of axes. One is simply the varied nature of the players, ranging from start-ups and industrial firms to automotive OEMs, which are making both direct investments in lidar R&D and equity investments in lidar firms. The authors also cite the range of technologies driving the market at present, including the familiar macroscopic mechanical scanners of Velodyne, upcoming MEMS-based and miniaturized scanners, and the phased-array systems proposed by Quanergy, built on fiber technology.

Another variable widely discussed in the lidar arena is the wavelength of the signal. While some players have opted for 830-to-940-nm wavelengths to take advantage of available optical components, according to the report, firms (including Blackmore, Neptec, Aeye, and Luminar) are increasingly turning to longer wavelengths in the also-well-served 1550-nm wavelength band, as those wavelengths allow laser powers roughly 100 times higher to be employed without compromising public safety. And while most lidar companies opt for traditional pulsed, time-of-flight lidar, the report suggests that a few are experimenting with continuous-wave ranging that allows for heterodyne detection.

Not for everyone?

![]()

The Yole analysts, like other industry watchers, see lidar as only one sensor component for autonomous vehicles. [Image: Getty Images]

The report also notes a few potential imponderables in the picture. Most important, it suggests, is that not every car maker has opted for lidar as the eyes of its autonomous systems. Some, such as Tesla and the Chinese firm TuSimple, will instead rely on other kinds of systems—including, potentially, radar, which has begun to gain better imaging capabilities; traditional cameras tricked out with artificial intelligence and machine learning; and infrared imaging. The authors of the Yole report, like numerous other industry observers, however, believe that the robotic and ADAS vehicles of the future will ultimately need to include a suite of all of these features, and perhaps others, to pass muster in terms of public safety (see “Lidar for self-driving cars,” OPN, January 2018).

Even as the market works through the best approach, there are indications that lidar development is becoming an increasingly international affair, according to a separate study from the French market-research firm KnowMade (a sister company of Yole). The KnowMade report notes that lidar-related patent activity got off of the ground in the late 1980s among Japanese automotive firms, and that the “first wave” of lidar IP players has consisted of Japanese and (to a lesser extent) European firms. But “since 2010, the IP landscape related to LIDAR for automotive has seen a strong increase,” according to KnowMade, “with the established/strongest IP players increasingly challenged by new pure players and international companies entering the IP landscape.”