Alex Cable, Thorlabs founder and chief executive

Alex Cable, Thorlabs founder and chief executive

In the first article of this two-part series, I sketched out the process leading to Thorlabs’ definition of its target audience: the time-starved technologist working to advance the science and technology of photonics. But how does a company put such a definition into action?

It boils down to specific choices—and, critically, whether those choices support your business’ uniqueness and reinforce your strategy. Your choices must not be the same ones your competitors have made, or could easily make.

A powerful strategy that defines a unique position in chosen markets is among the most important components to designing a business. Thorlabs’ choice to be vertically integrated, for example, with our own machine and glass shops, set us apart from many of our early competitors—and continues to be effective today.

Thorlabs’ strategy has, from the start, been all about complete customer centricity: we run our business to ensure that our customers cross their finish line faster. We have implemented this strategy throughout the organization via our people, processes, structure and systems. This strategy acts as a filter through which all decisions, large and small, need to pass, and gives our staff a context in which to view their contributions. And, when market needs have demanded it, the strategy has been able to adapt.

Leveraging Activities

Really effective strategic activities will reinforce each other so as to uniquely position the business to serve customers’ needs. To be most effective, these activities either need to be something competitors can’t easily copy or ones that provide little advantage to them if borrowed, as they don’t naturally fit their strategy.

For example, our choices to publish pricing, focus on customer speed and manufacture in-house all come together to provide a network effect, where the strategic strength of the whole is greater than any of the constituent parts. I view this as a business version of Metcalfe’s Law, where each activity acts to increase its value by n2 with n being the number of activities (in this example, n = 3). It’s imperative that the activities be related; without mutual reinforcement, there’s no network amplification of the strategic value over the simple sum of the individual activities.

If a savvy competitor does emerge that copies your activities well, and they all happen to fit its business model and strategy, then it’s time for a new strategy.

Developing a customer-centric strategy

As our target audience is the “time-starved technologist,” our first strategic priority is respect for each customer’s time. We have done this by publishing prices; by taking, processing and shipping orders in real time; and by answering the phone by the third ring. We also built—in the pre-internet days of the 1990s—production and systems to ensure same-day order fulfillment.

We have practiced a fair-pricing methodology, setting our prices based on our manufacturing costs and not on what the market will bear—a choice that has eliminated the need for customers to use precious time in price negotiations. We would accept any product returns our customers requested, with no need to discuss. And we carefully organized our sales sheets and, later, our catalogs, layering the presentation so that the information needed to make a buying decision comes first—another way to respect our customers’ time.

Insourcing. We quickly realized that outsourcing a significant fraction of our production (principally for machined aluminum component parts) was at odds with our same-day shipment strategy. Our vendor base struggled with random spikes in demand, common in our business.

Having trained as a machinist in an earlier career, my own roots in manufacturing allowed Thorlabs to build up in-house production, to shore up our supply chain to meet our strategic objective. While we couldn’t produce 100 percent of our component parts—as we were growing much faster than I could afford to build capacity—we could take on the more challenging designs, while also reserving emergency capacity for the random spikes in demand.

Adapting the strategy

Most strategies, if not all, have a shelf life, and benefit from periodic review. Thorlabs does this annually, with in-depth reviews every five to ten years. We’ve been fortunate that our initial strategy lasted from 1989 to 2003—and the same strategy, with one major addition, has carried us from 2003 to today, with another in-depth review now underway.

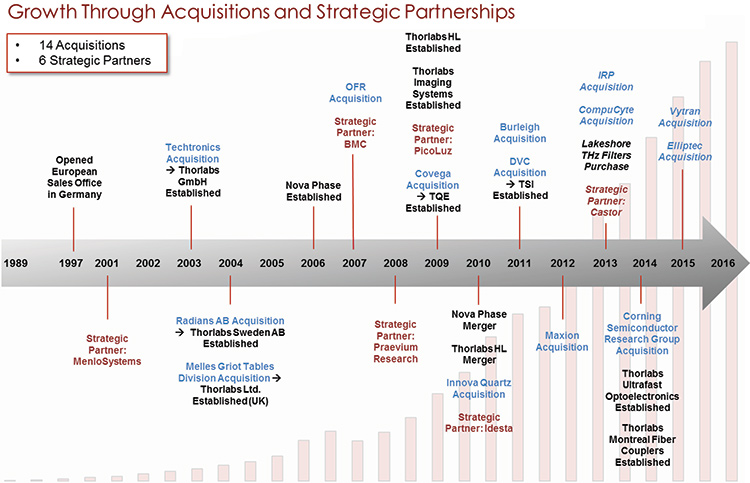

The major addition in 2003 was to add growth through acquisitions and greenfield initiatives (funding internal and external startups) to the core customer-centric strategic elements of our early years. Such opportunities must provide mutual reinforcement (Metcalfe’s power-of-two amplification) when inserted into our core business.

Over the past 13 years we’ve acquired 14 companies, either through outright stock purchases or via asset purchases. Those years of shopping provided a unique education, allowing Thorlabs to develop a well-defined approach to growth through acquisition that reinforces our strategy. We seek businesses that have products that either fit into our product portfolio or that can be repurposed to strengthen that portfolio.

Our purchases often have a theme. Starting in 2012, for example, we made three acquisitions as part of a multiyear effort to better serve the mid-IR market—Maxion Technologies, a quantum cascade laser (QCL) design and production group; IRphotonics, a fluoride fiber production facility; and, most recently, the Corning semiconductor group, a leader in the production of QCLs, which we consolidated into our Jessup, Maryland-based semiconductor foundry, acquired in 2009 with the purchase of Covega. Today, Thorlabs’ mid-IR segment is one of its fastest-growing divisions.

Keeping ahead

At our start, while we adhered to the engineering standards of the time, we also sought out design innovations that lowered costs or enhanced performance. Today, in-house manufacturing goes as far as doing our own epitaxial wafer growth in a complete, end-to-end InP and GaAs foundry that takes in raw materials and ships out complete optical coherence tomography imaging modules. Everything in the modules—the lasers, the MEMS tuning element, the hermetically sealed pigtailed packaging, the electronics, the fiber optic clocking circuit, the balanced receivers, even the fiber optic couplers—is manufactured within one of our facilities.