The rare earth elements are a group of 17 elements that occur together in the periodic table.

The rare earth elements are a group of 17 elements that occur together in the periodic table.

Optics and materials science have enjoyed a long and fruitful collaboration. Advances in optics are often made possible through the use of advanced materials designed to tune light-matter interactions—just think of solid-state lasers, polarization filters or optical fibers. In turn, materials science has progressed by leaps and bounds thanks to optical interrogation techniques such as confocal microscopy, pump-probe spectroscopy and ultrafast lasers.

But today, perhaps for the first time, optical and materials scientists find themselves bound together in a story that has made headlines around the world. Seemingly overnight, optical scientists and engineers, economists, trade specialists, mining experts and political leaders are all talking about rare earth elements. These metals and their parent oxides are woven throughout modern optics: erbium-doped optical fibers, Nd:YAG lasers and ytterbium-based optical atomic clocks are just some examples. Over the past 18 months, the combination of a sole supply source and a series of geopolitical events has sent rare earth prices soaring.

Supply disruptions, record material prices and a lack of alternatives may have dire consequences for the optics community and an optical components industry that rely heavily—and perhaps uniquely—on these materials to drive research and development.

About rare earth elements

The rare earth elements (REEs) are a group of 17 elements that occur together in the periodic table. The group consists of two transition metals and the 15 lanthanides: scandium, yttrium, lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium and lutetium. (We include scandium and yttrium in the definition of rare earths, following the International Union of Pure and Applied Chemistry. Some geochemists take “rare earth” to refer only to the lanthanides.) For many years, the chemical and geophysical similarities among these 17 elements actually hindered their identification as separate chemical elements.

Clockwise from top center: praseodymium, cerium, lanthanum, neodymium, samarium and gadolinium.

Clockwise from top center: praseodymium, cerium, lanthanum, neodymium, samarium and gadolinium.

History and discovery

The rare earths were first discovered accidentally by the Swedish Army Lieutenant C.A. Arrhenius. In 1787, Arrhenius came across an unusual black mineral at a quarry at Ytterby, a small town around 20 km from Stockholm, Sweden. In 1794, Johan Gadolin, a Finnish chemist at the University of Abo, separated a previously unknown oxide (“earth,” at the time). The names “gadolinite” and “yttria” were later suggested as names for the new mineral and oxide, respectively. A second novel heavy oxide was identified in 1803 from a mineral sample found earlier at Bastnas, Sweden.

The new oxides and minerals were given the name “ceria” and “cerite” after the planetoid Ceres, which had just been discovered in 1801. At the time, yttria and ceria were believed to be individual elements. By the early 20th century, these “earths” were known as they are today—as 17 similar but distinct chemical elements—thanks to separation and identification efforts that extended throughout the 19th century. Of the many new laboratory techniques that were applied to the problem, optical emission and absorption spectroscopy was key in establishing elemental purity and distinguishing one rare earth metal from another.

Rare earth technologies

REEs are crucial to a wide range of modern technologies. For example, hybrid vehicle batteries, oil refining and lighting technologies all rely on the chemical, optical and electro-optic properties of REEs. Despite their broad technological applications, however, media attention in Asia, Europe and the United States has focused almost exclusively on their application to clean and green energy technologies. In particular, much ink has been spilled on the uses of Nd, Sm, Pr and Dy in NdFeB and SmCo “rare earth magnets” for wind turbines and electric vehicle motors, and La, Ce, Pr and Nd for batteries for hybrid electric vehicles.

As important as REEs are to these transformational technologies, the story of their use in optical science is just as compelling, if not more so. The unique optical properties of rare earth ions are crucial to the technologies that power the Internet (lasers and optical fibers), lighting and plasma televisions (phosphors), prescription eyeglasses and microscopes (optical polishing compounds) and even the GPS app on your iPhone (atomic clocks for GPS).

REEs, lasers and optical amplifiers

Since Theodore Maiman’s ruby laser demonstration in 1960, metal ions have been used as gain centers in solid-state lasers. After the invention of the laser, the race to improve on Maiman’s design, which lased from chromium ions (Cr3+) embedded in a sapphire (Al2O3) matrix, led to an aggressive search for alternative substrates and gain centers. Among the best substrates were glass, yttrium aluminum garnet (Y3Al5O12, or “YAG”) and calcium fluoride (CaF2); the best gain centers were rare earth metal ions, including Nd3+, Tb3+, Ho3+, Dy3+, Eu3+ and Er3+. The most successful and lasting combination was the familiar Nd:YAG laser operating at a wavelength of 1,064 nm.

Nd:YAG lasers

In an Nd:YAG laser, the active Nd3+ ions replace aluminum atoms at low concentrations within the YAG crystal matrix. Rare earth ions offer an important technical advantage as versatile lasing materials: The quantum energy levels of the ion, which dictate the lasing wavelength, remain relatively unperturbed by the host crystal matrix. This allows rare earth ions to be used as lasers in a wide range of host crystals.

For example, when optically excited, free Nd3+ will fluoresce strongly around 1.06 mm. When embedded in a YAG or glass matrix, the fluorescence wavelength barely changes. Normally, Stark shifts (energy level shifts due to electric fields inside the crystal) alter the fluorescence wavelength of ions embedded in crystals. For triply ionized rare earth ions such as Nd3+, however, fluorescence is associated with electrons in the partially filled 4f inner shell of the atom, which is shielded from the crystal matrix by the outer filled 6s electron shell. Thus, Stark shifts are minimal for rare earth ions.

Nd:YAG is a textbook example of an idealized four-level laser system. Nd:YAG lasers are among the most stable, common and useful solid-state lasers in use today. They have found both continuous wave (cw) and pulsed application in everything from precision spectroscopy to optical tweezers and optical traps, to laser eye surgery and other tissue therapies.

There are also many variations of the Nd:YAG lasers that are available on the commercial market today. Different lasers use various combinations of ionic dopants, such as Nd:Cr:YAG or Nd:Ce:YAG, to tune the laser performance to suit a specific application. Other variations on this theme are the Er:YAG at 2,940 nm, as favored in dentistry, and the Yb:YAG at 1,030 nm.

Fiber lasers and optical amplifiers

After Nd:YAG lasers, fiber lasers and fiber optical amplifiers may be the second most recognizable rare-earth-based optical technologies. Many major optical component retailers advertise “rare-earth-doped” fibers that are made with various cladding schemes, core materials and dopants. The active element of a modern fiber laser and many fiber amplifiers is a rare-earth-ion-doped optical fiber. As with solid state lasers, Er, Yb, Nd, Tm or some other rare earth ion serve as the active gain centers.

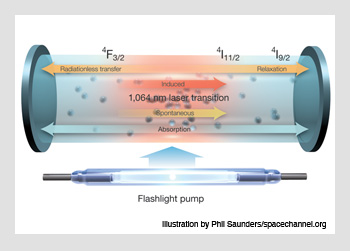

Nd:YAG lasing occurs on the 1,064 nm transition from the 4I11/2 to the 4F3/2 atomic energy level. Starting in its 4I9/2 ground state, Nd3+ ions in the YAG crystal are optically pumped into a broad manifold of upper “pump band” levels. From there, the ions undergo a rapid, nonradiative relaxation into the 4F3/2 state, and stimulated emission causes a transition from 4F3/2 down to 4I11/2. The resulting light emission becomes the laser's optical output. The cycle ends with another rapid, nonradiative relaxation from 4I11/2 back to the ground state.

Nd:YAG lasing occurs on the 1,064 nm transition from the 4I11/2 to the 4F3/2 atomic energy level. Starting in its 4I9/2 ground state, Nd3+ ions in the YAG crystal are optically pumped into a broad manifold of upper “pump band” levels. From there, the ions undergo a rapid, nonradiative relaxation into the 4F3/2 state, and stimulated emission causes a transition from 4F3/2 down to 4I11/2. The resulting light emission becomes the laser's optical output. The cycle ends with another rapid, nonradiative relaxation from 4I11/2 back to the ground state.

In the common “double-cladding” fiber laser, the lasing mode propagates in the fiber core, which itself is the rare-earth-doped active region. The inner cladding houses a pump light, and the outer cladding behaves as a traditional cladding for the pump.

Lighting technologies

The key material in modern lighting technologies is luminescent phosphor, which is a generic term for a radiative material that emits light by luminescence from a small fraction of atoms in the material called emission centers, which, in many cases, are rare earth ions. In lighting applications, the phosphor is “charged” using optical or electrical pumping, which induces fluorescence from the emission centers.

The ongoing technology booms in indoor lighting and color electronic displays have driven demand for rare earth elements. A thin coating of a rare-earth-based luminescent phosphor can be the main light source (e.g., cathode ray tube displays), or it may serve as a filter or color addition to a main source, as in the case of compact fluorescent light bulbs and plasma televisions.

For example, to achieve “cooler” (bluer) white light, Ce3+-doped garnets or Eu2+ silicates are commonly used as blue or yellow phosphors. For “warmer” (redder) whites, Eu2+-doped nitrides or sulfides provide the necessary red phosphor. Another red phosphor, which is commonly used in plasma televisions, combines Eu2+ ions with the inert host material BaMgAl10O17 (“BAM”). The Eu2+:BAM is sometimes coated in another rare-earth compound, lanthanum (III) phosphate, H3LaO4P, to prevent oxidation of the Eu2+ ions that ultimately causes degradation of the Er luminescence characteristics.

Optical atomic clocks

Rare earths are used in the laser-cooled oscillators in ultra-high precision all-optical atomic clocks. Every clock is based on an oscillator whose cycles mark the passage of time. In mechanical clocks, the oscillator is a spring; in quartz watches, a vibrating piezoelectric crystal. In an atomic clock, the oscillator is the atom itself, whose outermost electron has been made to oscillate steadily between two internal energy levels.

A new generation of optical atomic clocks use optical transitions to achieve “ticking” frequencies in the THz range rather than the GHz microwave range of the classic cesium microwave clock. The Yb+ clock, for example, has a clock frequency roughly 75,000 times higher than that of a Cs microwave clock. The higher frequency means that time intervals can be subdivided more precisely, and with lower systematic uncertainty. Yb+ is used because of its large mass and low nuclear spin, both of which help to increase the stability and accuracy of the clock. Yb also has the technical advantage of being relatively easy to laser-cool, which is essential in cooling clock atoms down to their microkelvin operating temperature.

Optical polishing compounds

The utility of REEs in optical science is not limited to their optical properties. Rare earth oxides are also prized as industrial polishing compounds for high-performance passive optics. The best example is cerium oxide (CeO2), which is mixed with water in a polishing slurry that is used to polish lenses, waveplates and mirrors with unmatched speed and precision.

Cerium oxide’s industrial utility makes it the most heavily consumed REE product in optics. Unlike Er and Tb, which are used primarily as dopants, and which have industrial annual consumption measurable in kilograms, industrial cerium oxide consumption is measured in tons. This makes the cerium-oxide-dependent optical manufacturing sector particularly sensitive to REE price fluctuations. The recent global price increases of REEs have affected the optics supply chain most acutely through cerium oxide and optical component manufacturing.

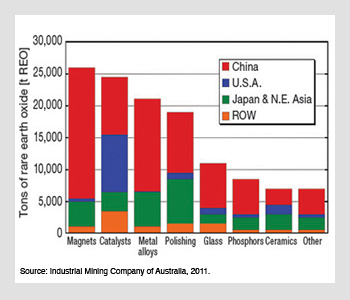

Estimated global rare earth consumption by sector. Magnets, polishing, glass and phosphors are all integral industries within optical science and technology. Rare earth oxide consumption is dominated by high-tech manufacturing in Asia, with the notable exception of fluid catalytic cracking in the United States petroleum industry.

Estimated global rare earth consumption by sector. Magnets, polishing, glass and phosphors are all integral industries within optical science and technology. Rare earth oxide consumption is dominated by high-tech manufacturing in Asia, with the notable exception of fluid catalytic cracking in the United States petroleum industry.

Global rare earths supply chain

The long list of technological applications of REEs shows just how important these materials have become to our modern economy. Despite their widespread uses in optical metrology, oil refining and the hybrid automotive industry, nearly all of the world’s REEs are sourced from a single country—China.

The growing demand for advanced technologies with REEs has created a unique global tension with important industrial, economic and political ramifications. Entangled in all of this are the optical science and technology communities, which so far have been at the mercy of these larger economic forces. To understand how China’s export dominance affects the optics community, it is important to appreciate some of the history of REE production in the United States and around the world.

Mining and processing

Rare earth elements are actually not rare at all. Cerium, for instance, is estimated to be the 25th most abundant element in the Earth’s crust, making it nearly as common as copper. Though each chemical element has a slightly different terrestrial abundance, in very broad terms the REEs as a group are three to four orders of magnitude more abundant than the rarest elements, such as iridium, rhodium and palladium. They are also three to four orders of magnitude rarer than the most abundant, rock-forming elements, such as oxygen, silicon, calcium, aluminum, magnesium and iron. The most important rare-earth-containing minerals are bastnasite and monazite, each of which is composed of a mixture of all 16 stable rare earth oxides. (The 17th—promethium—is unstable and can be found only in trace amounts in natural ores.) Separating the oxides and the pure REEs is a multi-step process, involving solution processing, physical grinding and chemical separation.

Global ore production

Until the early 1990s, the United States led global production of bastnasite by a wide margin, and it was also a major producer of monazite. The other major world producers included Australia, Brazil, India, Malaysia, Sri Lanka, Thailand and South Africa. During that time, the United States was also the leading exporter of oxides, rare earth alloys and refined products. All of this began to change as China steadily developed its REE resources throughout the 1980s and 1990s. As Chinese REE production came in online at new, lower market prices, international REE mining, refining, alloying and manufacturing firms slowly but surely declined, folded or relocated to China. Today, China produces an estimated 97 percent of the world supply of rare earth oxides.

That China would come to dominate REE production is not so surprising, given that its borders contain an estimated 36 percent of global REE resources. The United States, the former leading producer, accounts for an estimated 13 percent of world resources. However, it is generally recognized that China was able to overtake the United States and all other producers in price, quantity and quality due to a targeted and sustained government effort to capitalize on China’s “strategic” economic advantage in these materials.

REE mining and processing projects are being restarted and explored in the United States, Canada and Australia, but none are at full production today. With the exception of the Molycorp mine at Mountain Pass, Calif., U.S.A., all are at least a decade away from stable production.

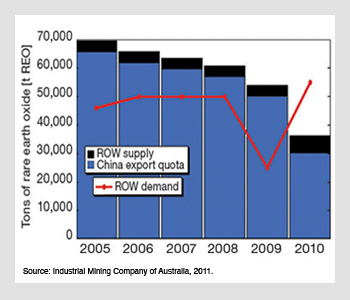

Rare earth supply and demand. World demand for rare earths grew even as Chinese exports decreased through 2010.

Rare earth supply and demand. World demand for rare earths grew even as Chinese exports decreased through 2010.

The other side of this supply chain story is global demand. Almost single-handedly, China has met the world’s demand for oxides, purified rare earth metals, rare earth magnets and many optical technologies for several years. However, with the exponential growth of China’s domestic manufacturing of wind turbines, plasma televisions and hybrid electric vehicles, the country’s own domestic need for REEs has increased as well. Today, China’s own requirements constitute 60 percent of world demand, and this is steadily increasing. Though this situation has created its own tensions in the REE industry, the recent price shocks, media frenzy and political attention all began with a series of geopolitical events in the summer of 2010.

Geopolitics

In September 2010, Japan and China entered into a dispute that focused world attention on REEs. The conflict arose when Japanese officials arrested and detained the crew of a Chinese fishing boat after it collided with a Japanese patrol boat in disputed waters. In response to these events, the Chinese stopped making REE exports to Japan. As the crisis deepened, other nations reported reduced access to Chinese REE exports as well.

Though Chinese officials denied that any government policy directed the restriction of REE exports, it seems clear that access to Chinese REE products was limited in Japan, Europe and North America for a short time in 2010. Chinese export quotas for 2010 had already been reduced by 40 percent compared to 2009 levels. However, in December 2010, China announced an 11 percent cut for the first half of 2011. REE prices spiked and metals and commodity markets churned.

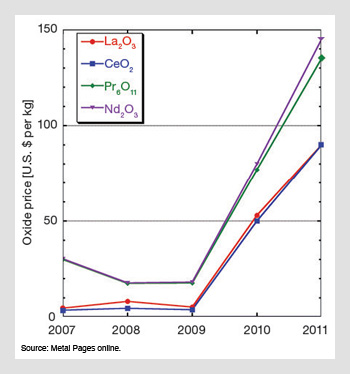

Today, REE prices are still experiencing unprecedented highs, and they show no signs of abating in the near future. Cerium metal prices were stable at just over $10/kg from April to July of 2010, when they rose suddenly to $40/kg. By December 2010, the price had passed $50/kg, and today it sits at roughly $140/kg. Cerium oxide prices have shown a similar run up, from around $4,000/tonne in late 2009 to around $90,000/tonne today. Other REE metals and oxides, particularly those in highest supply such as Ce, La, Nd, Tb and Dy, have also experienced dramatic price increases. This has spread uncertainty throughout commodity markets, technology industries, the media, and policymaking and political communities worldwide.

Ramifications for the optics community

What does all of this mean for optical science and technology? Though optical applications account for a small fraction of total REE demand, REE dopants, additives and magnets are absolutely crucial to many research programs, technologies and industries within optical science.

Representative rare earth oxide prices. Along with metal prices, oxide prices have soared in recent years. The 2007-2010 figures are fourth-quarter (Q4) average prices. The 2011 numbers represent spot prices on February 25.

Representative rare earth oxide prices. Along with metal prices, oxide prices have soared in recent years. The 2007-2010 figures are fourth-quarter (Q4) average prices. The 2011 numbers represent spot prices on February 25.

Rare earth price increases have been felt most keenly by optical component manufacturers and retailers. Major optical equipment suppliers report that production costs have steadily increased for passive optical elements, rare earth magnets (and their associated optomechanical products) and rare-earth-doped optical fibers. Small consumers have largely been shielded from these steep price increases so far—with the exception of REE-dense products such as NdFeB magnets and cerium oxide polishing powder. However, optical component manufacturers and retailers may be hard pressed to keep prices at recent levels in the face of rising REE prices.

Having REE materials lightly spread throughout optical components also presents a serious problem for recycling. Optical components are rarely recycled, so the constituent rare earth components are usually lost to landfill. Japan leads the world in rare earth recycling efforts, with an emphasis on NdFeB and SmCo magnets, and batteries, in which the REE materials are used in relatively high concentrations. Recycling programs have received much international attention since Chinese REE supply disruptions hit the front page, and for good reason: Recycling will undoubtedly play an important role in the future management of REEs and other critical materials.

But we are not there yet: REE recycling today only generates a tiny fraction of total world REE supply. Nevertheless, the potential of REE recycling remains appealing in Japanese, German and American policy circles; research and development is under way, but full-scale deployment is likely still some years away.

Another option is to develop alternative material technologies that do not rely on REEs, or any other materials that are subject to scarcity or supply uncertainty. For optical technologies such as solid-state lasers, in which REE materials have been selected for their superior technical performance above all other considerations, this may be easier said than done. With myriad laser technologies available today, rare-earth-free solid-state lasers are certainly a practical alternative. Other technologies, such as CeO2 for polishing, whose industrial use depends on cost and availability in addition to performance, may be better positioned to transition to alternative material systems in the near term.

The key to realizing both recycling and alternative materials is research and development. Without continued efforts to master the materials science, chemistry and physics of REEs and their associated technologies, the industrial, technological and scientific communities that rely on REE materials will remain at the mercy of the broader macroeconomic and political drivers of these materials systems.

Broader perspectives: critical materials

REEs are important materials for optical science and technology, but they are not the only ones. Lithium, gallium, indium, tantalum and niobium are just some examples of other rare metals that are absolutely critical to modern electronics, optics and computing. Their scarcity and technological importance, together with the REE story explored here, raise broader questions about the management of critical materials in our technological society.

The U.S. National Research Council of the National Academies addresses this topic in a recent report titled “Minerals, Critical Minerals, and the U.S. Economy.” Using the concepts of scarcity, importance and supply uncertainty, their 2008 report suggests a framework for defining a “critical mineral,” tracking its status through time, and some policy tools for ensuring a long-term stable supply of critical materials to support important technologies. Their recommendations have a degree of common sense that most laboratories, businesses and individuals can relate to: Management of scarce resources requires planning ahead! The optics community is not likely to come undone over REE supply uncertainties, but it is important to be aware of the issues, and to support the responsible management of the key technologies, materials and resources related to these critical elements. Keeping the optical science community involved in the REE conversation is an important step in that direction.

Marcius Extavour, most recently a quantitative risk analyst at Ontario Power Generation, is currently serving on Capitol Hill as the OSA/SPIE Arthur H. Guenther Congressional Science and Engineering Fellow.

References and Resources

>> K.A. Gschneidner Jr., ed. "Industrial Applications of Rare Earth Elements," ACS Symposium Series 164, based on the proceedings of the 180th American Chemical Society National Meeting, Las Vegas, Nev., August 1980, American Chemical Society, Washington, D.C., U.S.A., 1981.

>> A.E. Siegman. Lasers, University Science Books, Mill Valley, Calif., U.S.A., 1986.

>> "Minerals, Critical Minerals, and the U.S. Economy," report by the National Research Council of the National Academies, Chair. R.G. Eggert, The National Academies Press, Washington, D.C., U.S.A., 2008.

>> "Critical Materials Strategy," U.S. Department of Energy report, December 2010.

>> D.J. Kingsnorth. "Meeting the Challenges of Supply this Decade," Industrial Minerals Company of Australia, 2011.

>> "Rare Earths," U.S. Geological Survey, Mineral Commodity Summaries 2011.