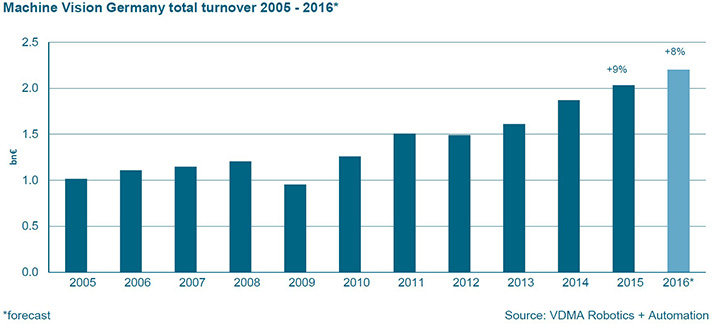

According to the VDMA survey, German machine vision sales expanded nearly 100 percent between 2005 and 2015. The organization forecasts an 8 percent sales gain for this year. [Image: VDMA Machine Vision]

Germany’s Mechanical Engineering Industry Association (Verband Deutscher Maschinen- und Anlagenbau, or VDMA) recently reported that the country’s machine vision industry logged sales of €2 billion in 2015, a 9 percent year-to-year gain and a new record for the industry. VDMA looks for an 8 percent gain, to €2.2 billion, for 2016. That increase, if achieved, would mark the fourth straight year of revenue increases for the German machine vision business, according to the trade group.

An umbrella group of some 3,100 companies that bills itself as Europe’s largest industry organization, VDMA has been conducting its machine vision market survey every year since 1995. The 2015 survey included more than 180 companies, and the reported 2015 revenues for the German industry were nearly double the figure of ten years earlier.

Demand from “Industry 4.0”

In a late August press conference announcing the survey findings, Horst Heinol-Heikkinen, a board member of VDMA’s machine vision arm, noted that both the 2015 growth and projected gains in 2016 and beyond were driven largely by “Industry 4.0”—the trend toward automation and “smart” manufacturing, in which machine vision plays a key role. Machine vision is, according to a press release accompanying the survey findings, “both a trailblazer and the key technology for meeting the challenges of Industry 4.0.”

The automotive industry alone accounted for some 22 percent of German machine vision revenues last year, and revenues from that sector booked a 9 percent gain. The electrical/electronics and display industries have likewise been big consumers of machine vision from Germany, according to the VDMA survey, with the demand coming from increasing use of machine vision in quality control.

Perhaps surprisingly, however, the survey found the most rapid growth rates in nonindustrial settings, which, together, accounted for around 25 percent of total German machine vision revenues last year. These nonindustrial applications include “intelligent” traffic systems, which saw a particularly sharp rise; medical applications; logistics; and other areas.

Hotspots for 2016

Geographically, around 23 percent of German machine vision sales last year went to the European market, 21 percent to Asia (with 9 percent going to China alone), and 12 percent to North America. Demand from China, which expanded 19 percent, and the German home market, which increased 13 percent, both logged gains well above the 8 percent overall growth rate.

For 2016, the organization looks for continued smart growth of 15 percent in Asia and a gain of 14 percent in North America. VDMA is a bit more cautious about Europe, where some of the question marks “include future developments in the price of raw materials, exchange rates, and last but not least, the effects of political crises.” The latter is perhaps, in part, a veiled reference to the still-unquantified impact of the U.K.’s Brexit decision.